Daily Tech: Strategic Capital Flows Accelerate in AI and Quantum Sectors

- futuregatecapital

- Jun 10, 2025

- 3 min read

FutureGate | June 10 2025

Nebius Deploys Nvidia B300 GPU Cluster in U.K. to Strengthen AI Compute Leadership

Nebius AI (NBIS) confirmed plans to deploy Nvidia’s new B300 GPU cluster in the United Kingdom, further reinforcing its ambition to be a leader in sovereign-grade AI infrastructure. The B300 chips are designed for hyperscale AI workloads and are expected to deliver a 30%+ performance improvement over the previous generation (H100), thanks to architectural advancements in memory throughput, tensor core scaling, and multi-node networking.

This expansion supports both private and public sector demand for domestic AI compute capacity amid growing concerns over data sovereignty and latency constraints in cross-border cloud usage. From an investment perspective, Nebius’ move not only aligns with Nvidia’s expanding enterprise footprint but also positions the U.K. as a strategic node in the global AI infrastructure race — which continues to attract sovereign capital and long-duration institutional interest.

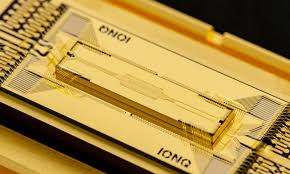

IonQ Acquires Oxford Ionics for $1 Billion+ to Consolidate Quantum Advantage

IonQ (NYSE: IONQ) has agreed to acquire Oxford Ionics, a U.K.-based quantum hardware firm, in a transaction exceeding $1 billion, combining two of the sector’s most promising quantum tech stacks. The deal is aimed at bridging IonQ’s photonic quantum systems — known for modularity and high-fidelity control — with Oxford’s silicon-based trapped-ion platforms, which allow integration with existing semiconductor manufacturing processes.

This merger is a strategic step toward commercially viable, fault-tolerant quantum computing. By fusing photonic qubits and chip-level ion traps, IonQ anticipates delivering scalable quantum machines with reduced error rates, higher coherence times, and easier fabrication — key milestones in enterprise adoption.

For institutional investors, this represents a bet on vertical integration in quantum hardware, and echoes the M&A playbooks of the semiconductor sector in the 1990s, when convergence led to rapid commercialization and valuation re-ratings.

Alibaba Shares Climb on Signs of Easing U.S. Export Controls

Alibaba (NYSE: BABA) saw its shares rise 1.76% on renewed optimism around U.S.-China trade thawing, especially in relation to semiconductor and AI technology export controls. For Alibaba, whose cloud division has been hindered by chip restrictions, this shift could enable broader rollouts of AI-native services in markets outside of China. A normalization of tech trade would also reduce long-term compliance risk and lower capital costs for global expansion. From a portfolio perspective, Alibaba's undervaluation relative to U.S. tech peers continues to offer asymmetric upside if geopolitical risk premiums are reduced.

AMD Rallies on Citi Upgrade, Acquires Untether AI Team for Strategic Inference Edge

Advanced Micro Devices (NASDAQ: AMD) rallied over 4%, driven by a Citigroup price target revision, citing momentum in AI GPU demand and improving visibility in server market share gains. The rally was further supported by AMD’s acquisition of Untether AI, a Toronto-based startup specializing in energy-efficient inference processors for edge deployments and low-latency AI workloads.

Untether’s custom-built architecture, which integrates massive SRAM banks for near-memory compute, offers a viable path to meet surging demand for inference accelerators in medical imaging, autonomous driving, and smart factories. AMD’s integration of Untether’s engineering team strengthens its position versus Nvidia and Intel in the edge AI space — a segment expected to grow at a 30% CAGR through 2030.

This acquisition aligns with AMD’s broader diversification beyond GPUs and CPUs, offering investors exposure to the full AI pipeline — from cloud to edge.

Comments